Used 2014 Audi A4 2.0t Premium Plus Insurance

2014 Audi A4 Insurance Rates

Enter your zip code below to view companies that have inexpensive auto insurance rates.

UPDATED: Jun 13, 2015

Advertiser Disclosure

It'southward all about you. Nosotros want to aid y'all make the correct coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparing shopping should be piece of cake. We are non affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance manufacture partnerships don't influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to utilize the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything machine insurance related. Nosotros update our site regularly, and all content is reviewed by machine insurance experts.

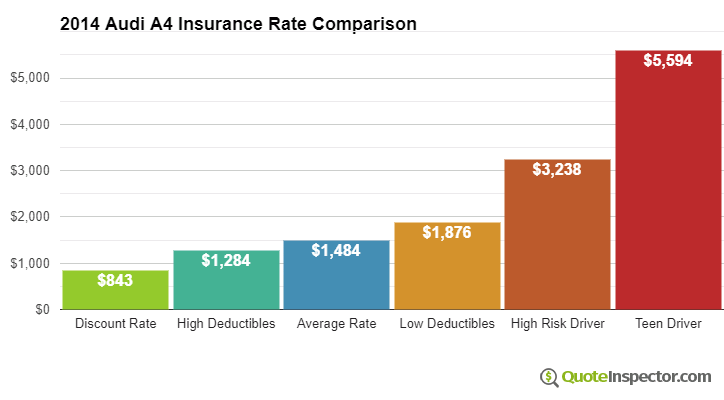

Boilerplate insurance rates for an 2014 Audi A4 are $i,340 a year for full coverage insurance. Comprehensive insurance costs approximately $258, standoff costs $464, and liability costs around $460. Buying a liability-only policy costs as low as $510 a year, with high-take chances insurance costing $2,908 or more. Teen drivers receive the highest rates at $five,128 a yr or more.

Annual premium for total coverage: $ane,340

Charge per unit estimates for 2014 Audi A4 Insurance

Comprehensive $258

Collision $464

Liability $460

Rate information is compiled from all 50 U.S. states and averaged for all 2014 Audi A4 models. Rates are based on a 40-year-sometime male driver, $500 comprehensive and collision deductibles, and a clean driving record. Remaining premium consists of UM/UIM coverage, Medical/PIP, and policy fees.

Price Range by Coverage and Chance

For a 40-yr-old commuter, prices range go from as low as $510 for just liability coverage to a much college charge per unit of $two,908 for high-chance insurance.

Liability Only $510

Full Coverage $1,340

High Risk $2,908

View Chart as Image

These differences illustrate why anyone shopping for car insurance should compare prices using their specific location and risk profile, instead of making a conclusion based on price averages.

Employ the course beneath to get rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Recommended Companies for Cheap 2014 Audi A4 Insurance

Searching Companies

Trying to find the cheapest machine insurance rates? Buyers take options when searching for affordable Audi A4 insurance. You can either spend your time calling around to get rate comparisons or leverage the internet to brand rate comparisons.

There are both good and bad means to observe auto insurance online so nosotros're going to tell yous the proper way to cost shop coverage for a new or used Audi and get the everyman possible toll either online or from local insurance agents.

It's a great practice to toll shop coverage periodically because rates change regularly. But because you had the everyman cost for A4 coverage a few years ago you can probably detect a lower rate today. So just forget annihilation you know (or recollect you know) nigh motorcar insurance because you're going to acquire the only way to save on auto insurance.

If y'all take a current insurance policy or are shopping for new coverage, you can use these techniques to get lower rates and perchance find even ameliorate coverage. The purpose of this postal service is to instruct you on the best way to quote coverages and some coin-saving tips. Consumers just need an understanding of the near effective way to store their coverage around over the internet.

Which Car Insurance is Cheapest?

Most companies such as Progressive, Allstate and GEICO requite coverage toll quotes online. Getting online rates is adequately straightforward every bit you simply type in your coverage data every bit requested past the quote grade. After you complete the class, the system gets reports for credit and driving violations and returns a price.

Online price quotes helps simplify price comparisons, but the process of having to visit several different sites and enter the aforementioned data into a course is not the all-time style to spend an afternoon. Only it'south absolutely necessary to compare equally many rates equally possible if you want to find the everyman motorcar insurance rates.

A less fourth dimension-consuming method to lower your rates requires only 1 form to return rates from a bunch of companies at one time. The course is fast, eliminates repetitive work, and makes quoting online much simpler. After sending your data, your coverage is rated with multiple companies and yous can pick whatever or none of the price quotes you receive.

If a lower cost is quoted, it's like shooting fish in a barrel to complete the awarding and buy coverage. This process takes fifteen minutes at the virtually and may effect in a nice savings.

To compare rates at present, click here to open in a new tab and enter your information. To compare your current rates, we recommend you lot duplicate the insurance coverages as shut as possible to your current policy. This way, you lot're receiving charge per unit quotes based on identical coverages.

Save $410 a year. For real?

Drivers constantly see and hear ads for the lowest toll auto insurance from the likes of Progressive, Allstate and GEICO. They all brand an identical promise nigh savings after switching your coverage to them.

How can each visitor say the aforementioned thing? It'southward all in the numbers.

All companies tin use profiling for the correct client that is profitable for them. For instance, a preferred adventure could be over the age of l, has no prior claims, and drives less than 10,000 miles a year. A driver who matches those parameters will go the preferred rates and is nigh guaranteed to save quite a bit of money when switching.

Potential insureds who don't authorize for the "perfect" profile will be charged a higher premium and this can result in business going elsewhere. The advert diction is "drivers who switch" not "everyone that quotes" save that much. That'due south why insurance companies tin can confidently make those claims.

That is why you absolutely need to quote coverage with many companies. It's not possible to predict which insurance companies volition provide you lot with the cheapest Audi A4 insurance rates.

Take discounts and relieve

Insurance can cost an arm and a leg, merely discounts tin can save money and in that location are some bachelor that you may not know about. Certain discounts volition exist practical when you lot become a quote, only some may not exist applied and must be inquired nigh prior to getting the savings. If you aren't receiving every discount you lot qualify for, you are throwing money away.

- Early on Signing – Some insurance companies reward drivers for signing upwardly before your current expiration appointment. This can save ten% or more.

- Paperwork-complimentary – Some insurance companies volition give a pocket-sized break simply for signing on their website.

- Driver Safety – Taking a defensive driving course could possibly earn you a 5% discount and easily recoup the cost of the grade.

- Organization Discounts – Participating in certain professional organizations could trigger savings on insurance coverage for A4 coverage.

- Educatee in College – Children who live abroad from home and exercise not have a car may be able to be covered for less.

- Good Student – Getting good grades can earn a discount of xx% or more than. Earning this discount can do good you until age 25.

Information technology'due south important to understand that most of the big mark downs will non be given the whole policy. Most cut the price of certain insurance coverages similar liability, collision or medical payments. Then fifty-fifty though information technology sounds like calculation up those discounts ways a gratis policy, insurance coverage companies aren't that generous. Any amount of disbelieve will reduce your premiums.

Auto insurance companies who might offer these discounts include:

- Progressive

- The Hartford

- Mercury Insurance

- GEICO

- AAA

- State Subcontract

Before buying, ask every prospective company which discounts you may be entitled to. Some discounts may not be bachelor everywhere.

Which policy gives me the all-time coverage?

When information technology comes to buying acceptable coverage for your personal vehicles, there really is no one size fits all plan. Everyone's needs are different.

For example, these questions may help highlight whether your personal state of affairs would do good from professional advice.

- Will my rates increase for filing one claim?

- Is a fancy pigment job covered?

- Do I demand an umbrella policy?

- When would I need additional glass coverage?

- Will I be non-renewed for getting a DUI or other conviction?

- Is my ex-spouse still covered by my policy?

- Am I covered if I wreck a rental car?

- Am I covered if I suspension a side mirror?

- What vehicles should carry emergency assistance coverage?

If information technology'southward difficult to reply those questions but a few of them apply, then you may want to recollect about talking to an agent. To observe an amanuensis in your surface area, fill out this quick form. It'southward fast, gratuitous and you can get the answers y'all need.

Coverages bachelor on your policy

Knowing the specifics of your policy aids in choosing the right coverages and the right deductibles and limits. Policy terminology tin can be difficult to empathise and coverage can change by endorsement.

Comprehensive insurance

Comprehensive insurance pays to fix your vehicle from damage from a wide range of events other than standoff. A deductible will apply then the remaining damage will be covered by your comprehensive coverage.

Comprehensive coverage protects confronting things such equally striking a deer, a tree branch falling on your vehicle and hitting a bird. The maximum payout a insurance company will pay at claim time is the ACV or actual greenbacks value, so if your deductible is as high every bit the vehicle's value it's probably time to drop comprehensive insurance.

Coverage for medical expenses

Coverage for medical payments and/or PIP pay for short-term medical expenses such as rehabilitation expenses, doctor visits, X-ray expenses and hurting medications. They can be utilized in addition to your wellness insurance policy or if there is no wellness insurance coverage. Information technology covers non only the driver but also the vehicle occupants and also covers getting struck while a pedestrian. Personal Injury Protection is not available in all states and may carry a deductible

Coverage for uninsured or underinsured drivers

This protects you lot and your vehicle when other motorists are uninsured or don't have enough coverage. Covered losses include medical payments for you and your occupants and damage to your Audi A4.

Since many drivers have only the minimum liability required by law, their limits tin can quickly exist used up. So UM/UIM coverage should not exist disregarded. Oft your uninsured/underinsured motorist coverages are similar to your liability insurance amounts.

Liability insurance

Liability coverage protects you from damages or injuries you inflict on people or other holding in an accident. This insurance protects YOU against claims from other people, and doesn't embrace your injuries or vehicle damage.

It consists of iii limits, bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. You might see policy limits of 25/50/25 that means you have $25,000 in coverage for each person'due south injuries, $50,000 for the unabridged accident, and a limit of $25,000 paid for damaged property. Another option is one limit chosen combined unmarried limit (CSL) which limits claims to i amount with no separate limits for injury or property damage.

Liability coverage pays for things such every bit attorney fees, medical expenses and funeral expenses. How much coverage you buy is your choice, but buy as high a limit equally you tin can afford.

Coverage for collisions

Collision insurance pays for damage to your A4 from colliding with another automobile or object. You first must pay a deductible so the remaining harm will be paid by your insurance company.

Collision coverage protects confronting claims like sideswiping another vehicle, rolling your car and sustaining impairment from a pot hole. Paying for collision coverage can exist pricey, then analyze the benefit of dropping coverage from lower value vehicles. Drivers also have the option to choose a higher deductible in order to get cheaper collision rates.

Don't pause the depository financial institution

Consumers leave their current company for any number of reasons including delays in paying claims, extreme rates for teen drivers, unfair underwriting practices and loftier prices. Regardless of your reason for switching companies, finding a great new company is not as hard as you call back.

The cheapest 2014 Audi A4 insurance is available on the spider web and also from your neighborhood agents, and then yous should be comparing quotes from both so y'all have a total pricing movie. Some insurance companies may non provide online quoting and many times these modest insurance companies only sell through independent insurance agents.

As you restructure your insurance plan, don't be tempted to reduce needed coverages to relieve money. There have been many cases where consumers will cede full coverage and learned later that the savings was not a smart move. Your strategy should exist to purchase a proper amount of coverage at a price you lot tin can beget, not the least amount of coverage.

More tips and info nigh insurance is located past following these links:

- Safety Features for Your New Car (State Subcontract)

- Should I Purchase an Umbrella Liability Policy? (Insurance Information Insitute)

- Auto Insurance for Teen Drivers with Divorced Parents (Allstate)

- Property Harm Coverage (Liberty Mutual)

DOWNLOAD HERE

Used 2014 Audi A4 2.0t Premium Plus Insurance

Posted by: cutleruner1985.blogspot.com

0 Response to "Used 2014 Audi A4 2.0t Premium Plus Insurance"

Post a Comment